In iPKO biznes service you can check whether your counterparties’ accounts are on the whitelist of VAT taxpayers (update: transfer bundles).

From January 1, 2020, for each transaction concluded between entrepreneurs and with the amount exceeding 15,000 PLN, company making the payment is required to check the VAT counterparty's account on the so-called "VAT whitelist". According to the regulations, transferring funds to an account that is not on the white list may result in sanctions.

You can now verify whether a given account is listed on the VAT whitelist directly on the iPKO biznes website. This functionality is available when creating one-time transfers, split payments and transfer bundles.

How does the verification work?

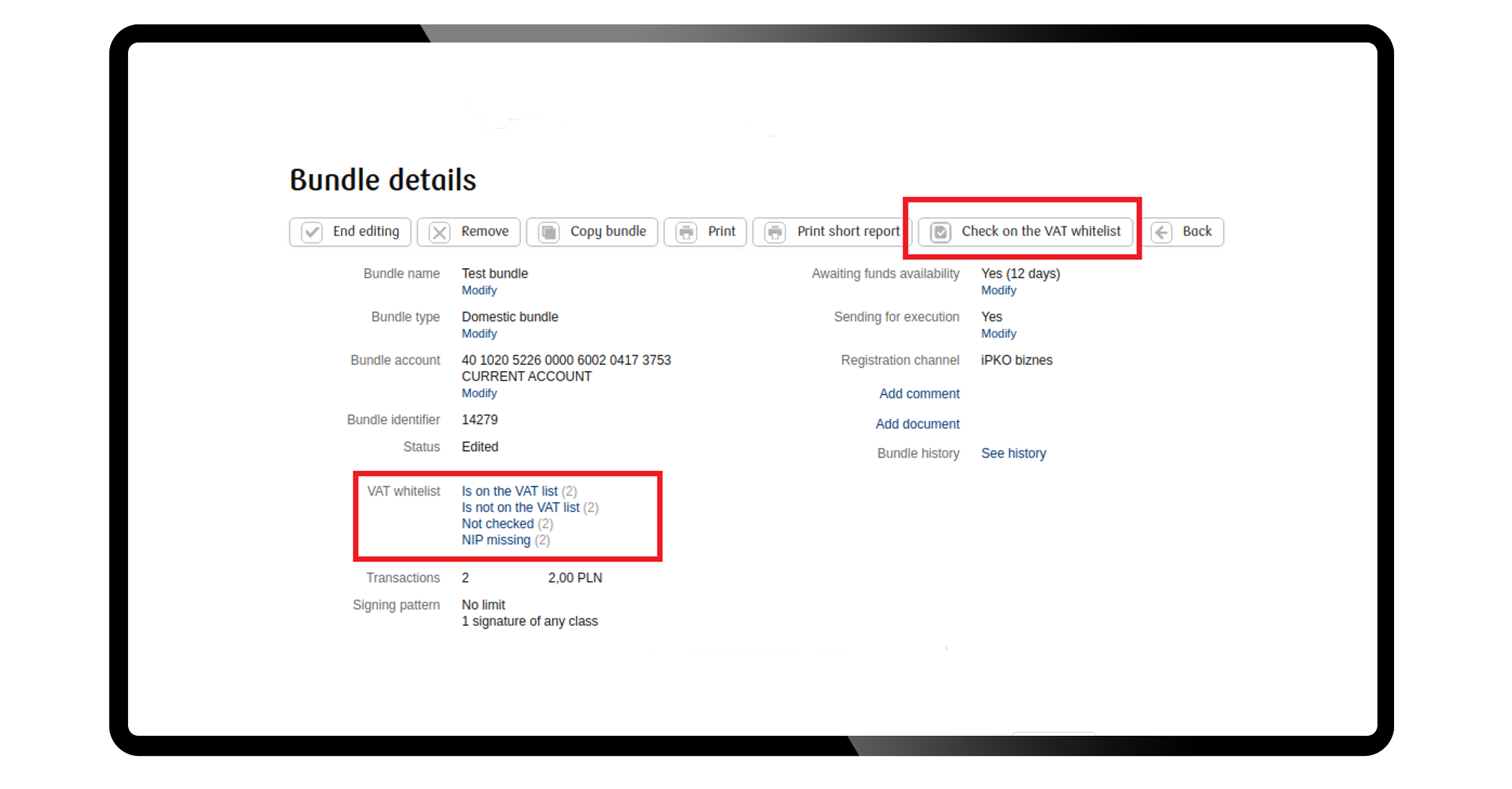

Transfer bundles

Choose Transactions > Bundles from the menu, then search for a specific bundle and click on its details (“eye” button) and then on “Check on the VAT whitelist”. The verification result will appear on the screen within short period of time.

You can select many transfers and transfer bundles in the transaction search at the same time and indicate them to be checked on the VAT whitelist.

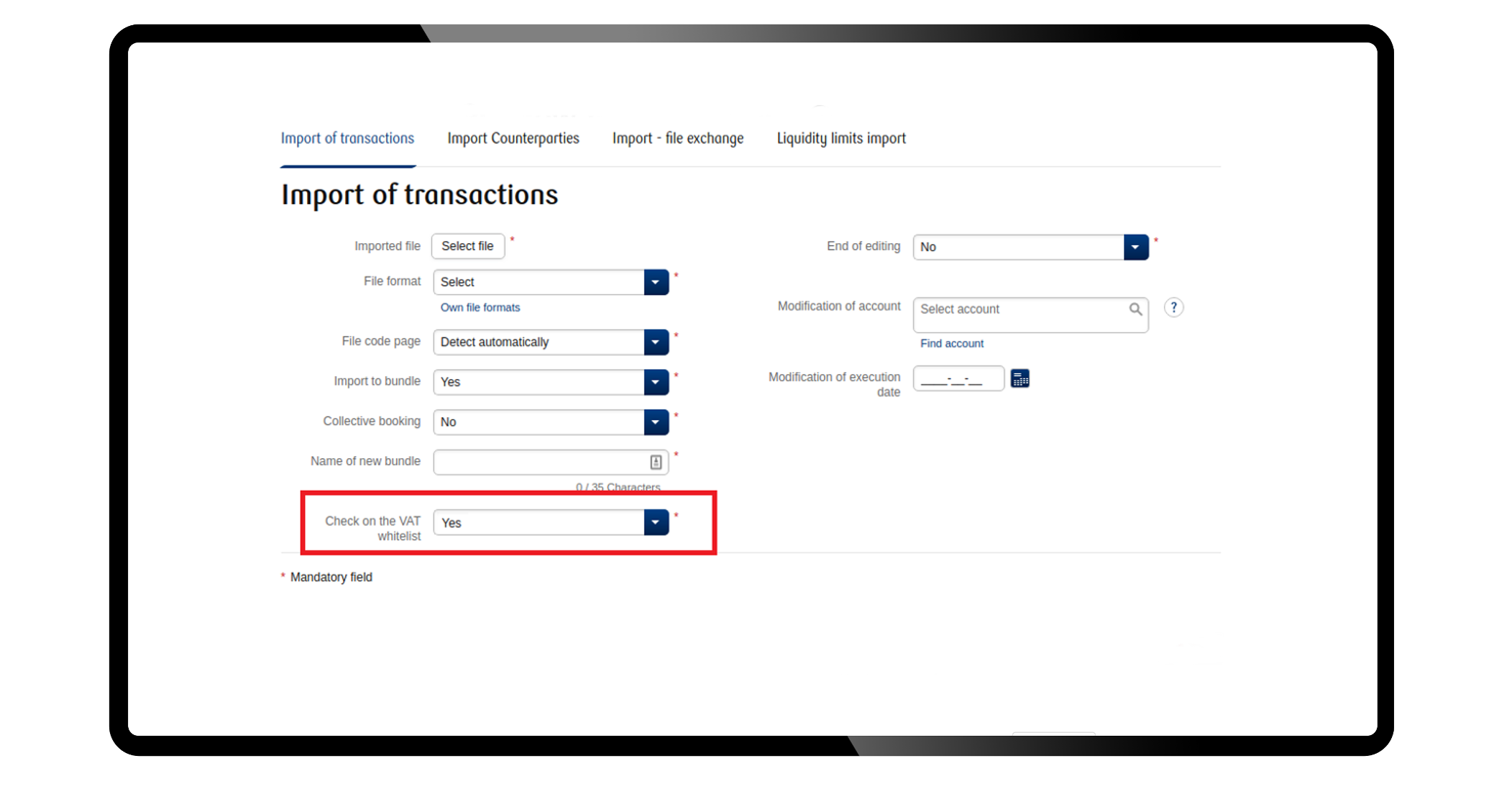

Import of transactions

You can also check if the counterparties’ accounts are on the VAT whitelist during the file upload. To do this, go to: Transactions > New > Import > Transactions. Choose Yes for the item “Check on the VAT whitelist”.

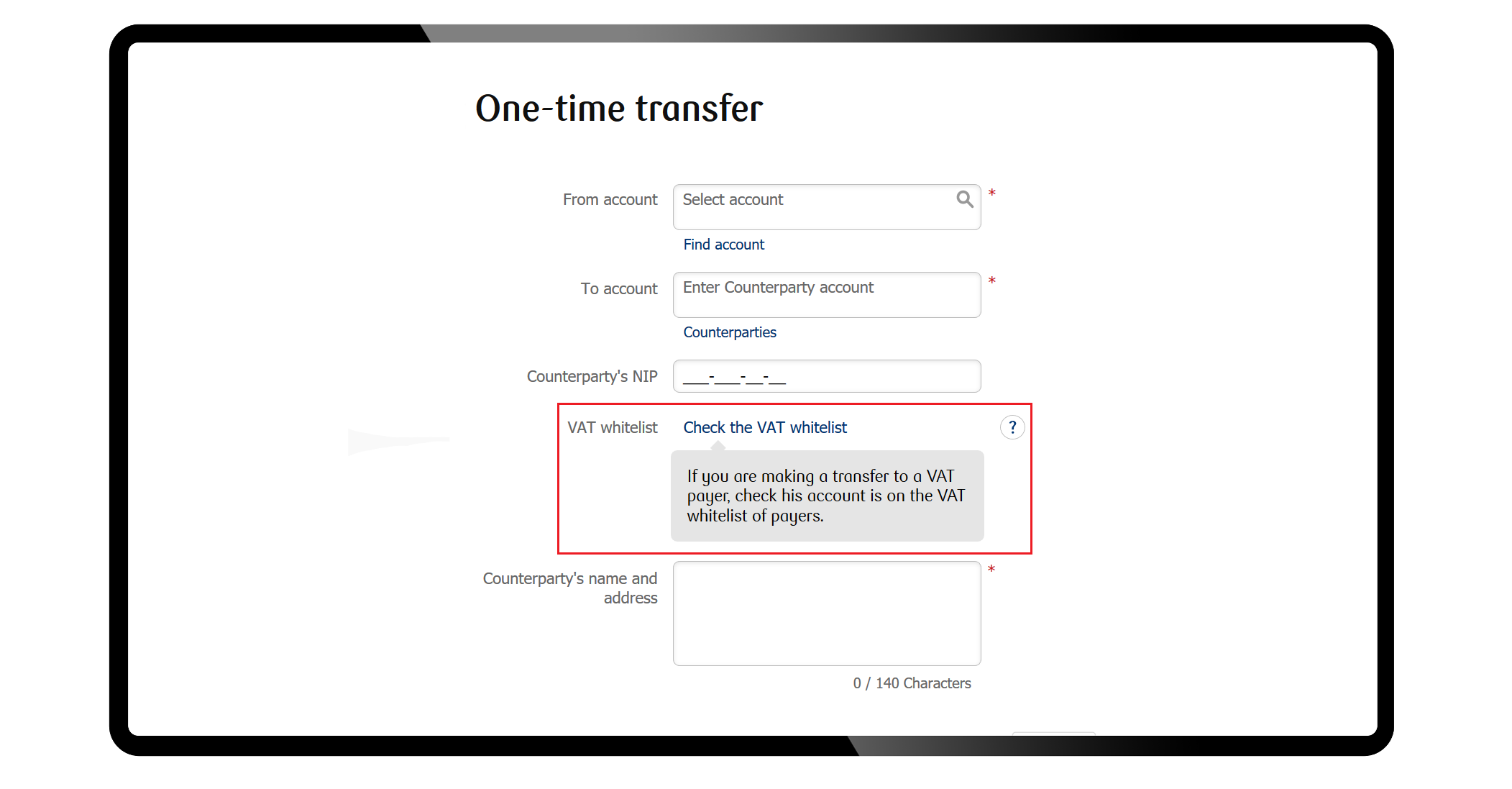

One-time transfer

Choose Transactions > New > Transfer > One-time in the menu. Complete the account number and the tax identification number (NIP) of the counterparty and then click on "Check the VAT whitelist" next to the field “VAT whitelist”. Verification can also take place while editing, signing or before sending the disposition.

The verification is based on the information provided by the Ministry of Finance.

Detailed information on the white list of VAT taxpayers is available at: https://www.pkobp.pl/aktualnosci/biala-lista/