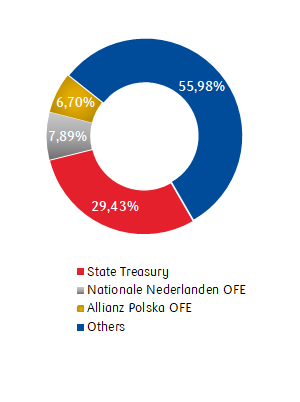

Shareholder structure

Information about shares

| Total amount of shares: | 1 250 000 000 |

| Nominal value of one share: | PLN 1 |

| Listed: | Warsaw Stock Exchange since 10.11.2004 |

| Indices: | WIG, WIG20, WIG30, WIG Banki |

| ISIN: | PLPKO0000016 |

| FISN: | PKOBP/BRSH SER-A-D PLN1.0 |

| LEI: | P4GTT6GF1W40CVIMFR43 |

| Bloomberg: | PKO PW |

| Reuters: | PKOB WA |

Information about shareholders (on 31.12.2024)

| Shareholder | Number of shares in the share capital / % | Number of votes at the General Meeting / % | Address | Contact | ||

|---|---|---|---|---|---|---|

| 367 918 980 | 29.43% | 367 918 980 | 29.43% | Ministry of State Assets | +48 22 695 86 90 |

| 98 669 361 | 7.89% | 98 669 361 | 7.89% | Nationale-Nederlanden PTE S.A. Topiel 12 00-342 Warsaw | +48 22 522 00 00 info@nn.pl www.nn.pl |

| 83 713 383 | 6.70% | 83 713 383 | 6.70% | PTE Allianz Polska S.A. | +48 22 567 46 00 |

| 699 698 276 | 55.98% | 699 698 276 | 55.98% | ||

| Total | 1 250 000 000 | 100% | 1 250 000 000 | 100% | ||